Capital Gains on Principal Residence

We receive many capital gains tax enquiries from clients regarding various issues around their principal place of residence. To clarify some key points we have put this blog together.

CAPITAL GAINS ON A RENTED PROPERTY - MINIMISATION USING THE 6 YEAR RULE

CAPITAL GAINS ON A RENTED PROPERTY - MINIMISATION USING THE 6 YEAR RULE

6 Year Rule

The 6 year rule allows a property to be treated as the principal residence for a further 6 years after moving out. The property may be rented in this time. The owner may have another property in which they live. Only one property may be treated as the principal residence at any time. If the original property is treated as the principal residence for the first 6 years and was rented out then any capital gain on the new residence in that 6 years would be taxable in the year that property was sold.

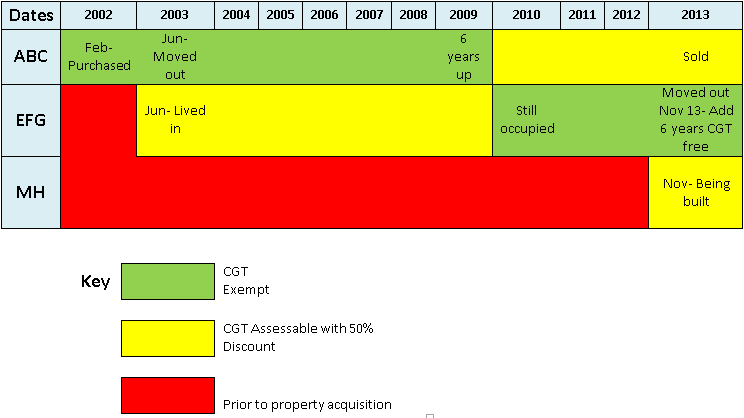

EXAMPLE : Capital Gains on the Sale of ABC Drive.

History.

The taxpayer purchased the property in ABC Drive in February 2002 and lived in it until June 2003, then rented it out until it was sold in 2013. The rented time was 10 years and 5 months

In June 2003 the taxpayer bought and moved into EFG Circuit until November 2013 at which time the taxpayer moved out, living with parents until the new home completed on MH property.

EFG Circuit was rented out at that time.

Capital Gain in ABC Drive commenced at the time it was rented it out in 2003. As it was the principal residence before you rented it out, the acquisition cost for capital gains tax purposes is the market value at the time it was first rented out. The capital gain is the difference between that market value and the net sale proceeds.

This capital gain on ABC Drive has been reduced by the option of treating ABC Drive as the principal residence for a further 6 years after leaving it.

The taxable gain is reduced to 42% of the gain being the remaining time of ownership from June 2009 to the date of sale in October 2013.

The actual capital gain of approximately $100,000 is reduced to less than $10,000 by applying all of the exemptions available.

When the second home in EFG Circuit is sold, it will not have an exemption for the first 6 years capital gain as the principal residence exemption can only be claimed on one property at any time.

The option to use the 6 year rule at the time of disposal of EFG Circuit will be available, as it may be treated as the principal residence for 6 years after first being rented out.

If this happens then any capital gain on the MH property (being the third property) in the first 6 years of ownership will be taxable when that property is sold.

The rules are complex and must be reviewed preferably prior to the sale to allow maximum planning opportunities. Speak to us at this time to enable us to assist you maximise any exemptions that may be available.

Important points to remember in maximising the advantage of the capital gains exemptions.

The 6 year rule only applies if the home has been lived in prior to renting it out.

It is best to always live in a property immediately after purchasing it, if possible.

Always remember to obtain a market value of the property when:

- you rent it out after having lived in it,

- at the end of the first 6 years of ownership if the 6 year rule has been used on another property, resulting in the principal residence exemption not applying

- and any other significant events that may require a market value