Important - JobKeeper Registration (not Expression of Interest)

There is a lot of confusion about the JobKeeper enrolment process for employers. Last week some 800,000 employers lodged an expression of interest for the JobKeeper Payment System, but this DOES NOT mean you are enrolled. If you want to claim the JobKeeper payment from the start (fortnight from March 30 to April 12) you must complete your enrolment BEFORE the end of April. Applications will remain open until the end of May.

How to Enrol

Employers need to log into the business portal on the ATO’s website https://bp.ato.gov.au/ using their MyGovID, where they can access JobKeeper enrolment forms. Please note, if your business was using an AUSKEY login last month, you will need to switch over to a MyGov ID. (The system switched over at the start of April.)

The application forms published by the ATO on Monday consists mainly of check boxes, requiring firms to declare how they want to apply the “turnover test” (explained below) or whether they want to be considered for the “alternative test”.

How do I identify eligible workers?

The ATO published new details on Sunday April 19 about the practical process of nominating workers for $1,500 fortnightly JobKeeper payments. Basically, there are two ways to identify eligible workers and officially nominate them with the ATO. Which option a business selects will likely depend on whether they are single touch payroll (STP) enabled.

- Businesses using STP reporting can identify their employees for JobKeeper participation through their payroll software (provided the software has updated its systems with the new functionality and you have the latest version of the software). Otherwise, businesses can use the ATO’s business portal, which should contain pre-filled payroll information from previous STP pay reports.

- Firms not reporting through STP will need to manually identify employees through the business portal and ensure this information is kept up to date each month.

All businesses that apply are also required to notify eligible employees they will be nominating on their behalf. Note that, if an employee does not want to receive JobKeeper payments, they are allowed to opt-out.

Business Eligibility for JobKeeper

Broadly speaking, there are two ways to get accepted into the JobKeeper Scheme - either pass the ‘turnover test’ or the ‘alternative’ test.

(a) The Turnover Test - or “basic test” is a five-step process.

- Identify the turnover test period (monthly or quarterly).

- Identify a relevant comparison period (the turnover test period, but in 2019).

- Determine relevant JobKeeper GST turnover (actual or projected).

- Determine which turnover reduction applies to you (30% for SMEs which aren’t charities).

- Work out if your turnover (step 1,2,3) has fallen by the required amount (step 4).

(b) The Alternative Test - only just been released by the ATO and is as follows:-

- The first alternative test compares the entity’s projected GST turnover for the relevant 2020 period with the average turnover since the entity commenced business. The calculation will depend on the relevant comparison period the entity uses and how long they have been in business.

- The second alternative test compares the entity’s projected GST turnover for the relevant 2020 period with the average turnover of the 3 months immediately before the applicable turnover test period. This test will use the most recent 3 months, which give a more accurate reflection of the entity’s GST turnover where the business has grown throughout the course of the year and the turnover in the earlier months is not reflective of the current business.

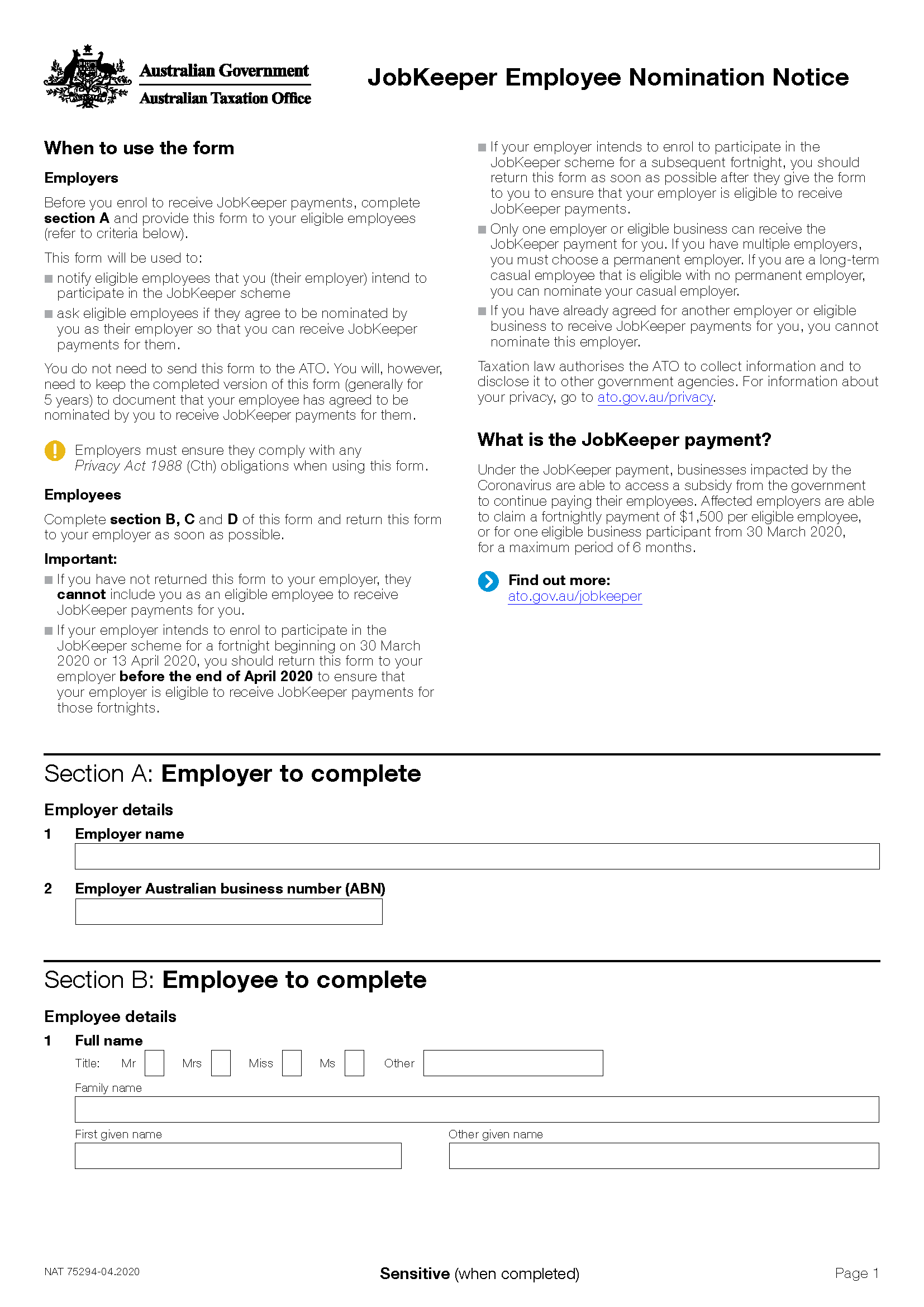

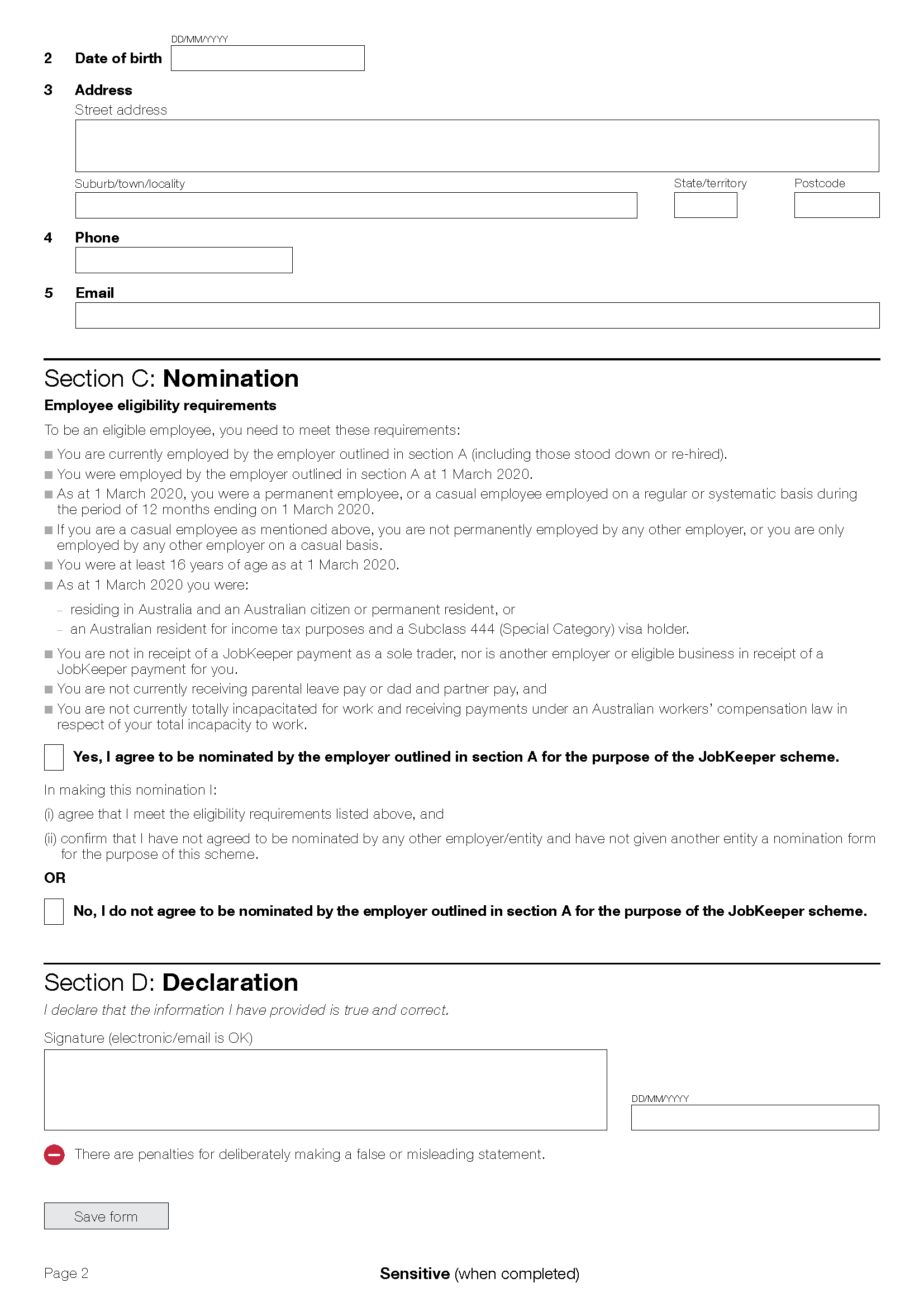

What Do You Need to Give Your Employees?

Employers need to give eligible workers JobKeeper Employee Nomination notices, which can be accessed here. These forms must be completed and should be kept as records, but do NOT need to be sent to the ATO. The form itself requests basic contact information and commits workers to declare their eligibility for the program.

Employees with multiple employers are allowed to choose which employer nominates them for JobKeeper payments but if they’re working as a

long-term casual in one role and part-time in another, the part-time employer must take preference.

Employees with multiple employers are allowed to choose which employer nominates them for JobKeeper payments but if they’re working as a

long-term casual in one role and part-time in another, the part-time employer must take preference.

Workers who are receiving or have applied for Services Australia income support will need to contact Services Australia and provide notice their employer has nominated them for JobKeeper.

Most importantly, the ATO said if an employee does not report JobKeeper or cancel their JobSeeker payments they may incur debts which employers will be required to pay back.

What Other Information is Required?

The ATO expects businesses to prove their eligibility for the JobKeeper program and will be required to provide business activity statements and other documents to support their claims. In addition, the ATO requires JobKeeper participating firms to make monthly declarations through the business portal about their eligible employees and turnover.

Each month participating businesses must reconfirm their eligible employees and notify the ATO of any change in employment circumstances.

JobKeeper Payments Overview

The JobKeeper subsidy is paid to eligible businesses effected by COVID-19 to cover the costs of their employee’s wages. Affected employers will be able to claim a fortnightly subsidy of $1,500 per eligible employee from 30 March 2020, for a maximum period of 6 months. This full amount of $1,500 must be paid to all eligible employees, whether they are full time, part time or casuals.

Here is a brief summary of how the JobKeeper payments are made:

- They are paid by the ATO within 14 days of month end.

- The first payment will be on 1 May 2020.

- The eligible payroll periods are every 14 days, commencing 30 March 2020.

- Monthly employer payroll reporting is required to trigger the payment by the ATO – using Single Touch Payroll (STP)

The employer will continue to receive the subsidy payments for eligible employees while they are eligible for the payments. While the program is expected to run for 6 months, payments will stop if the employee is no longer employed by the business.

If you are eligible to receive the JobKeeper payment for all your eligible employees for the entire six-month period, we estimate the total JobKeeper payments to be:

| NUMBER OF EMPLOYEES |

JOBKEEPER PAYMENT (per fortnight) |

NUMBER OF FORTNIGHTS (30/3/2020 to 27/9/2020) |

TOTAL JOBKEEPER AMOUNT |

| 1 |

$1,500 |

13 |

$19,500 |

| ELIGIBLE BUSINESS PARTICIPANTS |

JOBKEEPER PAYMENT (per fortnight) |

NUMBER OF FORTNIGHTS (30/3/2020 to 27/9/2020) |

TOTAL JOBKEEPER AMOUNT |

| 10 |

$1,500 |

13 |

$195,000 |

Business Participation Entitlement

Sole traders and some other entities (such as partnerships, trusts or companies) may be entitled to the JobKeeper Payment scheme under the business participation entitlement. A limit applies of one $1,500 JobKeeper payment per fortnight for one eligible business participant. Sole traders, one partner in a partnership, one beneficiary of a trust, and one director or shareholder of a company may be regarded as an eligible business participant.

Obligations & Risks

The key risks are, if the employer makes a mistake and is found to be ineligible by the ATO (for example, its turnover is not down by 30%), then they may have to repay all amounts received back to the ATO. Another risk is, an employee ceases to be eligible if they cease employment during the life of the JobKeeper scheme, and you continue to receive their payment. The ATO requires you to keep all records in relation to your JobKeeper claim for a 5-year period.

.jpg)

Need Help?

The ATO has specific actions that must take place within tight timeframes for an employer to receive the JobKeeper payment. These are the actions that we can assist you with:

Employer Eligibility Assessment – NOW

- Review ATO requirements for the business

- Review ATO requirements for employees

- Review ATO requirements for Business Participation Entitlement – Sole Trader, Partnership, Company or Trust

- Document the fall in turnover % in case of future ATO audit

- Complete your enrolment NOW

Identify Eligible Employees – NOW

- Prepare list of eligible employees

- Prepare JobKeeper employee nomination notice for all eligible employees and ensure all notices are signed

Enrol for JobKeeper – IMMEDIATELY

- Enrol for JobKeeper using ATO online services from 20 April 2020

- Provide employer bank account details for receipt of JobKeeper payment

- Confirm if applicant is entitled to a “Business Participation Payment”

- Specify the number of employees who will be eligible for one period and the number eligible for two periods

- Get confirmation that all employees the employer plans to nominate are eligible and the employer has notified them and has their agreement

Make Correct Wage Payments to Eligible Employees – NOW

- Ensure your payroll software is set up to record JobKeeper “top up” payments

- Pay the minimum $1,500 gross (before tax) to each eligible employee each fortnight (starting with the fortnight 30 March to 12 April) to be able to claim the JobKeeper payment for that first fortnight

- Continue to pay the minimum $1,500 to employees in every subsequent fortnight until 27 September 2020

Apply for JobKeeper Payments – FROM 4 MAY 2020

- Apply to claim the JobKeeper payment using ATO online services between 4 May 2020 and 31 May 2020

- Ensure all eligible employees have been paid $1,500 per fortnight

- Identify the eligible employees from a STP prefill or by manually entering into ATO online services

- Update your accounting system Chart of Accounts to ensure JobKeeper payments are coded correctly

Monthly JobKeeper Declaration Report – DUE BY 7TH OF EACH MONTH

Using ATO online services, report to the ATO using their Monthly JobKeeper Declaration Report on the following:

- Reconfirm that your reported eligible employees have not changed

- Input current GST Turnover for the reporting month

- Input projected GST Turnover for the following month

- Notify if any eligible employees have changed or left your employment